12 Financial Tools That’ll Instantly Upgrade Your Budget Game

Trying to master your money without the right tools is like trying to build a house without a hammer. Budgeting does not have to be painful or complicated, it just needs to be smart. Whether you are aiming to crush debt, track spending or grow your savings, the right app or platform can transform your financial life overnight. From old school spreadsheets to sleek AI-powered apps, these tools are helping Millennials, Gen Z and everyone in between make smarter choices with every dollar.

Spendee

Spendee is gorgeous and functional. It is one of the most visually appealing budgeting apps, with color coded insights and social spending features. Ideal for tracking both personal and shared expenses. You can create multiple wallets for travel, work, personal and categorize everything intuitively. For those who need beauty and brains in a budget app, Spendee delivers.

Simplifi by Quicken

Simplifi is the modern evolution of Quicken’s legacy, streamlined and made for mobile. With custom watchlists, cash flow forecasting and real time syncing, it adapts to your style. Whether you are paycheck to paycheck or building wealth, Simplifi keeps your eyes on the prize. The visuals are clean and the setup is fast. Think of it as the Fitbit for your finances. It has less guesswork and gives more clarity.

Related:12 Ways To Make Extra Cash Without Quitting Your Day Job

Honeydue

Couples who budget together stay together, especially with Honeydue. It lets partners share bills, split expenses and chat about money in-app. You can even react to transactions with emojis. It is cute, but functional. It supports transparency without merging accounts. Budgeting does not have to be stressful, it can be collaborative and fun.

Related:13 Money Habits From Around The World That’ll Blow Up Your Rulebook

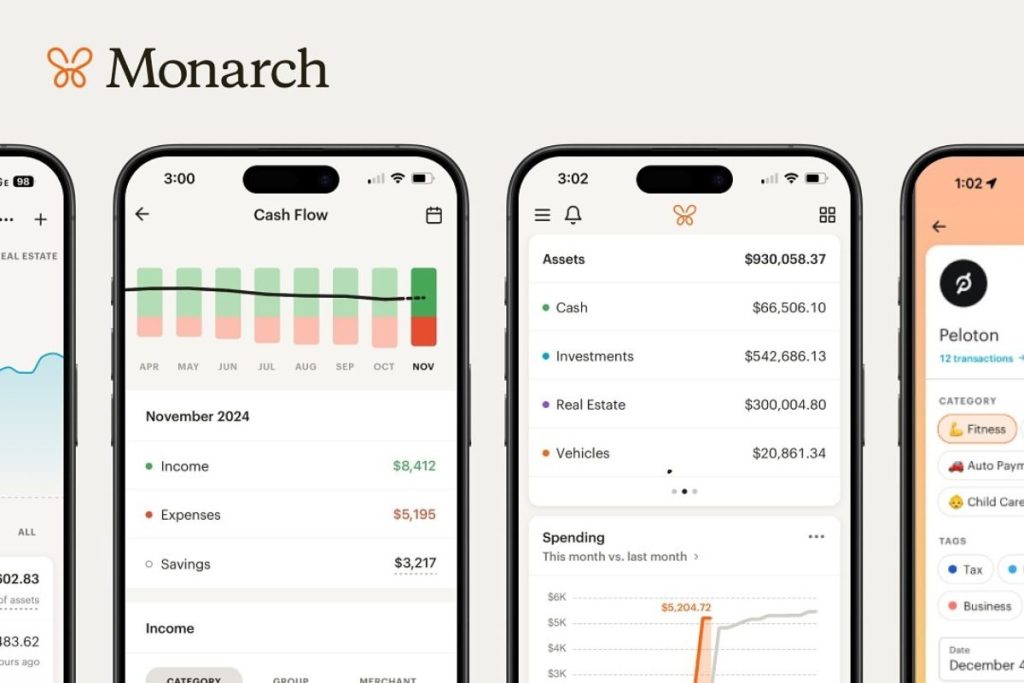

Monarch Money

Built by former Mint developers, Monarch is a sleek, powerful budgeting tool that puts you in control. It combines goal setting, real time transaction tracking and powerful analytics. Perfect for households, freelancers or solo users. You can track your net worth, debt payoff and savings progress, all in one dashboard. Monarch’s design is modern and intuitive.

Related: 13 Financial Myths That Are Quietly Sabotaging Your Wallet

Qube Money

Qube turns your debit card into a real-time budgeting tool. You load money into digital “qubes” and only unlock funds when making a purchase. It brings envelope budgeting into the 21st century, helping you spend with intention. If you are prone to impulse buys, this one’s a game-changer. Qube adds friction in a good way to spending. It is not restrictive, it is empowering. Your budget now lives in your wallet.

Related: 12 Clever Ways To Save Without Feeling Like You’re Suffering

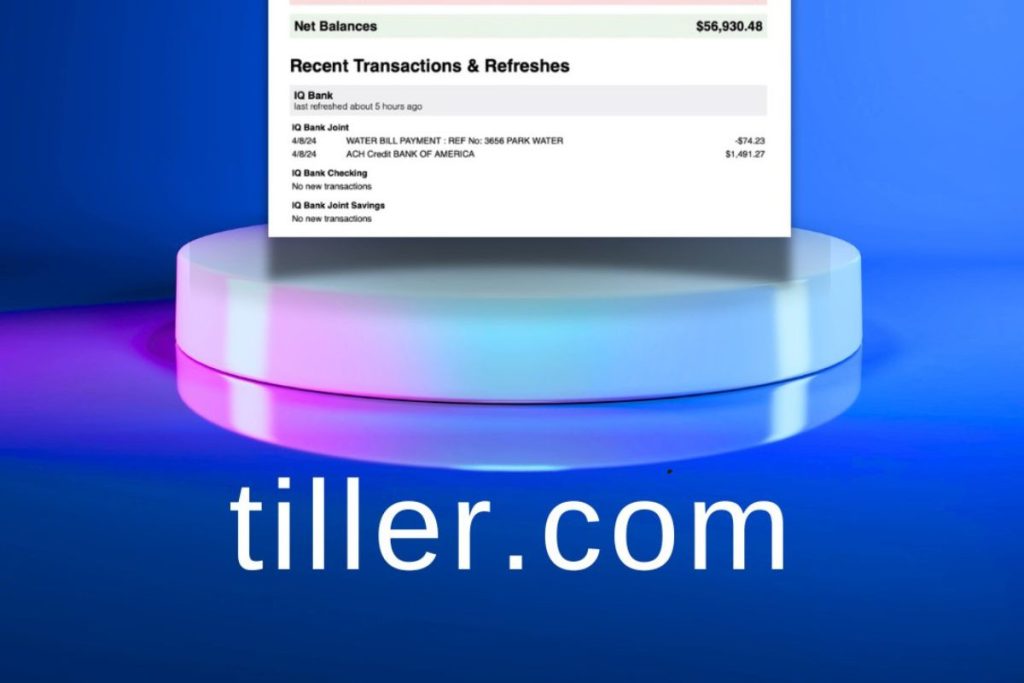

Tiller Money

If you love spreadsheets but hate building them, Tiller Money links your bank accounts to custom Google Sheets templates automatically. You get total control, no coding required. It is ideal for budget nerds who want full customization without constant data entry. Every transaction lands in your sheet daily. Charts, graphs and goals, it’s budgeting your way.

Related:14 Signs You’re Spending Like You’re Richer Than You Are

Empower, formerly Personal Capital

Empower blends budgeting with investing and net worth tracking. It’s more than just a monthly tracker, it shows your financial future. With visuals that highlight cash flow, retirement gaps and spending trends, it is like a financial health scan. Great for those who have started investing or are planning for long term goals. If Mint feels too basic, Empower feels like your money’s grown up.

Goodbudget

Envelope budgeting goes digital with Goodbudget. Instead of cash filled envelopes, you allocate digital ones. You assign money to each category, then spend from those “envelopes.” It’s perfect for people who want structure without linking bank accounts. You can also share budgets across devices for family or partner access. Simple, effective and old school budgeting vibes with a tech twist.

Related: 13 Budget Cuts That Won’t Ruin Your Comfort Zone

YNAB, You Need A Budget

YNAB does not just track your spending, it trains your brain to think like a budget boss. With a zero based budgeting method, it forces you to give every dollar a job. Whether it is rent, tacos or that emergency fund, YNAB keeps it honest. It syncs across devices and updates in real time. You will finally feel in control, not confused. There is a learning curve, but the payoff is huge.

Related: 12 Travel Hacks That Feel Luxe But Are Seriously Cheap

PocketGuard

If you constantly ask, “Can I afford this?” PocketGuard gives you a crystal clear answer. It shows how much you have left to spend after bills and savings. No math, just truth. With bank syncing, goal tracking and custom categories, it is brutally honest, but that is what makes it brilliant. You will stop overspending because now you will see it before it happens.

Rocket Money, formerly Truebill

Rocket Money is the hero you did not know you needed, especially if subscriptions are secretly draining your wallet. It scans for forgotten services, negotiates bills on your behalf and helps you cancel with one click. You can also track spending, set limits and review recurring charges. Think of it as your financial personal assistant. The premium version unlocks even more control.

Related:12 Retirement Moves You’ll Wish You Made In Your 30s

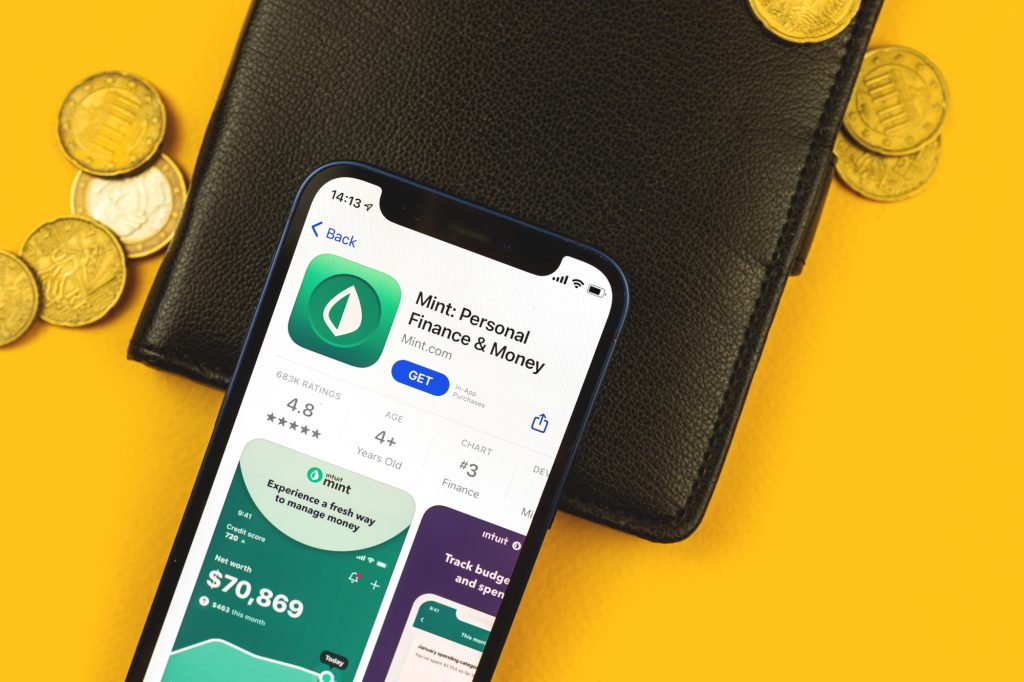

Mint

Mint is the OG of budget apps for a reason, it is simple, clean and free. Link your accounts, track your spending, monitor your credit and get alerts for unusual charges. Its color coded categories make overspending painfully obvious in a good way. Mint also helps with bill reminders and goals. It is beginner friendly but smart enough for pros. If you are new to budgeting and need something visual and immediate, Mint is your guy.

Related:12 Student Loan Hacks That’ll Wipe Out Debt Faster Than You Think

Budgeting is not about deprivation, it is about direction. These 12 tools do not just help you spend less, they help you spend better. Whether you are going solo, budgeting with a partner or scaling toward financial freedom, the right tool can turn overwhelm into empowerment. It is time to stop winging your finances and start owning them. Find the one that speaks your language and let it guide you to your richest self, silently, steadily and smartly

Disclaimer: This list is solely the author’s opinion based on research and publicly available information.

14 Signs You’re Spending Like You’re Richer Than You Are

In a world of flashy lifestyles and social media perfection, it is easy to fall into the trap of spending beyond your means. The illusion of wealth often leads people to adopt habits that do not align with their actual income. While it may feel empowering in the moment, these patterns can quietly sabotage long-term financial stability. If any of these signs sound familiar, it might be time for a money mindset reset.

Read it here: 14 Signs You’re Spending Like You’re Richer Than You Are

12 Creepy Things Brands Know About Your Spending Habits

In today’s data driven world, every tap, swipe and click tells a story. While most of us are aware that brands collect our data, few realize how deep that rabbit hole really goes. These companies are not just tracking purchases, they are building psychological profiles, predicting life events and even manipulating your emotions to influence your spending. From loyalty cards to facial recognition, the tactics are becoming eerily precise. What was once harmless marketing has evolved into full blown surveillance.

Read it here: 12 Creepy Things Brands Know About Your Spending Habits

13 Finance Red Flags Americans Keep Ignoring Until It’s Too Late

In a nation where financial literacy often takes a backseat, many Americans overlook subtle yet critical warning signs that can lead to long term financial distress. Recognizing these red flags early can be the difference between financial stability and hardship. Here are 13 financial red flags that are frequently ignored until it is too late.

Read it here: 13 Finance Red Flags Americans Keep Ignoring Until It’s Too Late

You’ll love these related posts: